An

Opinion By Jan Bergemann September 25, 2006

For

the sake of Florida’s citizens many of us still hope that the Florida

Property and Casualty Insurance Reform Committee doesn’t fit the profile

of the classic definition of a committee: “A group of

the inept appointed by the unwilling to do the unnecessary.” The

question all of us owners are asking is very simple. It was already asked

by St. Petersburg Times reporter, Tom Zuccho, in his article published on

September 18, 2006: “Who's

looking out for us?” As

explained in that article, the committee is comprised of politicians with

ties to the insurance industry, so-called experts, and business leaders! Actual

homeowners who are committee members? ZERO! Let’s

face it: The people, who are paying the price – some by losing their

homes – are not represented on this committee. And public input?

Considering the attitude of the committee members: As Little As

Possible! Who cares what the tax-paying citizen wants? I

don’t think there is any doubt that the owners in the so-called

Tri-County Area (Miami/Dade, Broward and Palm Beach counties) have been

hit hardest by the outrageous increases of property insurance premiums.

But the committee paid a token visit to Miami last Thursday, and then

changed public input from 9 a.m. to 10 a.m. instead of the pre-announced

time of 1 p.m. to 4 p.m. Let’s

make it very clear: By September 13, 2006, the committee still had no

official website. More than two months after its creation by Governor Bush

and after holding three meetings, the committee still had not published

its agenda for the Miami meeting. I finally called the Governor’s office

and got a telephone number to call. I explained the lack of information

and agenda in regard to the Miami meeting. A nice lady told me that there

is a website “in the making,” but then she told me that public input

for the Miami meeting was planned for the afternoon, 1 p.m. to 4 p.m.

As advised to do, I called again the next morning to confirm and

got the same information. But

when owners showed up to make their presentations at 1 p.m. they were

told: “Sorry, too late! We changed times and public input was only

from 10 a.m. to 11 a.m.” People came from as far as Palm Beach

County, only to be told: “Sorry, too late!”

It

seems obvious that common courtesy has no more room in our society – and

that the interest of the tax-paying citizens is left behind in the wake of

profits. In the meanwhile the Florida Property and Casualty Insurance Reform Committee has a website: http://www.myfloridainsurancereform.com/default.htm But

suspiciously missing: Any contact information or e-mail addresses. Looks

like the members don’t want to be bothered by Joe or Jane Homeowner!

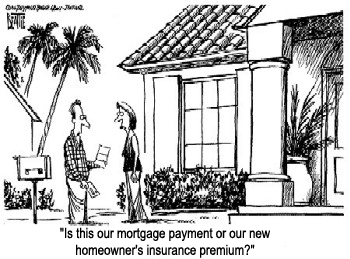

When I

received my insurance renewal notice this summer, the premium had nearly

doubled! So much for discounts! Folks,

if you haven’t realized it yet: WAKE UP! Property insurance

premiums and property taxes are destroying our finances, families are

losing their homes and many retirees are forced to move back up North,

where they can still afford the cost of living!

But

many owners quickly discover another serious problem when they try to sell

their former retirement “dream home.”

The real estate market has dried up.

It’s a buyer’s market now and the real estate prices are

going down even faster than the insurance premiums are going up!

Word gets around – and who wants to buy a house or condo in

Florida where the daily headlines in the media grumble about the problems

with property insurance, property taxes and association lawsuits? We

owners need real changes with reasonable premiums, premiums we can afford!

And if the insurance industry can’t supply these kind of policies, a

“socialized” insurance company run by the state has to be established,

but providing insurance for all risks, not only the bad risks the

insurance companies don’t like! Despite the huge losses they claimed

from the hurricanes, insurance companies paid out record amounts to their

shareholders! And we owners paid

the price! For

us citizens the time has come to take a stand: ALL OR NOTHING!

Insurance companies need to know: If you don’t want to underwrite our

bad risks, please don’t offer anything else! And for the big condo

associations we should look into creating a secure way of self-insuring!

(Enforced by strict government regulation, of course.)

Here in Florida we already see enough scam artists, who fleece the

widely unprotected citizens. There

is no more time for fun and games: When people are losing their homes,

it’s time to do something about it! When we followed the discussions of

the Destination Florida

Commission, we could still laugh and joke about it. We had fun

quoting: “Anybody who makes the decision to create a commission

sounds a lot like what Congress routinely does to make a hot issue go away

-- appoint a commission to study the problem to death and then ignore its

recommendations.” Maybe

we should now form a commission called “Destination North – Where

property insurance and taxes are still affordable”? Because

up North we can still find many places with an affordable cost of living,

reasonable insurance premiums, equitable property taxes for our homes --

and pleasant communities without mandatory associations. Here in Florida

we are being priced out of our homes – but so far our elected government

officials are not looking out for us! "We

The People" need to look out for ourselves and make sure that our

elected officials know: WHATEVER YOU DO, STOP THIS FINANCIAL DISASTER! Property

Insurance Premiums and Property Taxes are killing us! |