By JONI

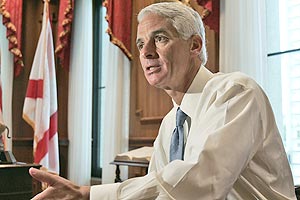

JAMES TALLAHASSEE - Gov. Charlie Crist pledged anew Monday to bring significant insurance rate relief to Florida policyholders during next week's special session, saying, "Big insurance has a new day coming, and it starts the 16th." Crist has yet to say exactly how he would take on insurance companies or cut rates, and he warned against too high expectations. "But people deserve high hopes," he said, "and I have them."

convene next week, but they also could take on more liability in the future. "It's pay me now or pay me later," said Sam Miller, spokesman for the Florida Insurance Council, which has contended its members' national profits don't reflect the real risk in Florida's market. "Reducing the pay me now and increasing the pay me later may be what we have to do" because of rising rates. Insurance companies have warned that significant new regulation could cause them to further retreat from their already diminishing role in Florida's property insurance market. The 153-page Florida Senate proposal - released 48 hours before either Crist's or the House's proposals are expected - is complex and wide ranging, addressing everything from strengthening the state's building code to making it harder for insurance companies to appeal regulators' rate rejections. Companies are also required to offer more policy options, such as higher deductibles or policies without windstorm coverage, so that individual policyholders can choose a cheaper premium in exchange for assuming more risk if their mortgage company will let them. The Senate plan does promise rate relief for customers of Citizens, the state-backed insurer of last resort. That's now one-in-three Florida homeowners. The plan would freeze premiums at the Dec. 31 rate, canceling a routine rate hike that took effect Jan. 1 and another planned for March 1. Last spring, lawmakers ordered the second hike, an average 56 percent more in Citizens' windstorm pool, to strengthen the pool's fiscal outlook. The Senate plan also proposes making it easier for insurers to buy reinsurance from the state, in exchange for passing any savings directly to consumers. The proposal could provide rate relief for customers of Citizens and private insurance companies. Reinsurance is basically insurance for insurance companies. But should Citizens or the state's reinsurance fund suffer deficit-causing losses as they did in 2004 and 2005, all Florida policyholders would be assessed to retire the deficit. House leaders generally have balked at the idea of putting more collective risk on all of Florida to provide coverage for properties on the state's hurricane-risky shores. And they are expected to challenge the Senate's strategy again. But even Rep. Don Brown, R-DeFuniak Springs, who will oversee insurance legislation in the House, acknowledges political reality has changed the dynamic. "Science is telling us rates are not high enough, and politics is telling us rates are too high. The paradox is they're both true. There's nothing you can say to convince policyholders rates aren't high enough (already)," Brown said. |