|

Floridians running out of options for home

insurance |

|

Article Courtesy of WINK NEWS

By Michael Hudak

Published

February 26, 2022

|

WATCH VIDEO |

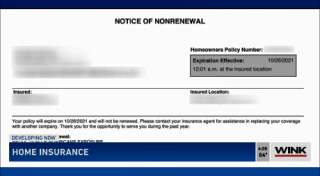

Five insurance companies are

pulling out of Florida, leaving homeowners with no choices in providers

and major price increases. It is an issue that has been ongoing in

Florida and with each season, is becoming worse.

|

Lawmakers know there is a problem and

they are working on a solution that is controversial because

critics say it favors insurance companies at the expense of

homeowners.

A bill lawmakers are debating would allow companies to not

offer replacement coverage for roofs more than 10-years-old.

WINK News asked Mark Friedlander of the Insurance

Information Institute if he would do business as an insurer

in Florida, “Haha, a loaded question. Thank you. I have to

compose myself for that.”

Friedlander operates out of northwest Florida but he feels

the pain of the whole state.

|

|

|

“The state of homeowners insurance in Florida right

now is in crisis, we are in serious crisis mode, where we’re on a

trajectory that the private insurance market could collapse,” said

Friedlander.

If that happens, Ken Skelton, and just about every other homeowner in

Florida, will feel the pain.

Skelton said his insurance, “It was almost doubled, went up. $1,700.”

Skelton’s insurance company jacked up his premium.

The Insurance Information Institute says only three out of 52 insurance

companies in Florida actually made a profit last year.

Friedlander said, “every insurer is losing money, and they’re losing a

lot of money.”

Those 52 insurance companies writing policies in Florida lost more than

$1.6 billion.

This year, fewer insurance companies will write policies in Florida

because of those losses.

That is forcing more homeowners to rely on Citizens Property Insurance

Corporation, the state’s insurer of last resort.

777,000 Floridians now use Citizens Property Insurance to protect their

homes. That is up 222,000 policies compared to 2020.

Florida State Senator Jeff Brandes said, “We have to fix it via

legislation, the courts are never going to fix it.”

Senator Brandes is frustrated by the fact Citizens Insurance is taking

on policies at a breathtaking rate and criticized the governor for

ignoring the problem.

“Yeah, property insurance is one of my big areas,” said Brandes.

Brandes has been thinking about this for a long time. “The state of

insurances, state of Florida is it’s essentially in collapse.”

A collapse that we cannot afford

“A people homeowners are going to find it very difficult to find

affordable coverage going forward unless the legislature acts,” Brandes

said. “Legislation fixes the incentive to sue your insurance company.”

Brandes believes state law makes it too easy to file suit against

insurance companies.

He points to the fact Floridians filed 100,000 lawsuits against

insurance companies in 2021 alone.

Friedlander, with the Insurance Information Institute, said, “more than

90% are considered frivolous. So very few would be considered

legitimate.”

Not everyone agrees with that.

“Yeah, there are some frivolous lawsuits. But for the bulk part of it,

they’re not. They’re just denied claims. It’s a numbers game for the

insurance company, if they deny 10 claims, maybe one gets awarded,” said

Property Attorney Chris Ligman.

Either way, something has to give. Ligman said, “we need to create

alternative dispute resolutions so that everybody doesn’t wind up in

court. And these insurance companies don’t end up going under because of

litigation.”

State lawmakers are considering a bill that would force state-run

Citizen Insurance to stop renewing policies if a private company offers

a premium that is not more than 20% more than Citizens’ rate.

|