Florida roofing company encourages homeowner to

make insurance claim for storm damage via text

Roofing company used a public

search engine to find homeowner |

|

Article Courtesy of ABC Action News

By Stassy Olmos

Published

May 16, 2022

|

WATCH VIDEO |

TAMPA — Florida homeowners say roofers are making

the deal for a new roof too good to pass up, but the real cost is

falling on insurance companies and residents across the state.

“It comes across as ‘Oh, I’d be foolish not to do this,'” said Pinellas

County homeowner Adam Schwebach.

|

An ABC Action News investigation found

Schwebach was targeted by a roofing company through his

personal information.

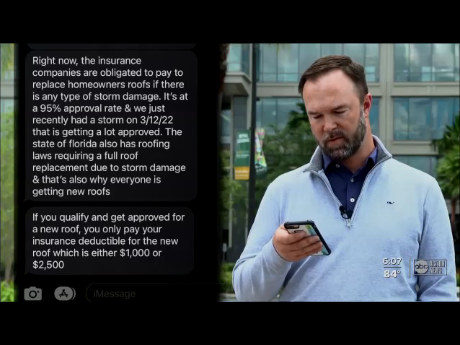

He received a text message at 8:35 p.m. on April 14 asking,

“Is this Adam.”

When he said "yes," the texts kept coming:

"This is Vincent with Citrus Contracting.. Tampa Bay Area

roofer. I got your number from truepeoplesearch.com instead

of knocking on your door & disturbing you.

Right now the insurance companies are obligated to pay to

replace homeowners roofs if there is any type of storm

damage. It’s at a 95% approval rate & we just recently had a

storm on 3/12/22 that is getting a lot approved.”

The state of Florida also has roofing

laws requiring a full roof replacement… and that’s why

everyone is getting new roofs.

If you qualify and get approved… you only pay your insurance

deductible for the new roof which is either $1,000 or

$2,500.”

|

|

Florida homeowners say roofers are making the deal

for a new roof too good to pass up.

|

Schwebach said he might have gone for it if he didn’t work in the

insurance industry.

“It’s just sad,” he said. “The way that it’s presented it is so easy for

someone who doesn’t know just to say, ‘Yes, come on out and look at my

roof and suddenly they’re going to file a claim.”

Governor Ron Desantis tried to stop this type of soliciting last year

with Senate Bill 76, but due to two lawsuits on freedom of speech, these

texts are technically legal.

We tried to call Vincent at the number the texts came from, but the

phone was off. We sent a text message, but it was never delivered.

We then looked up Citrus Contracting. It turns out they have offices all

over the state, but Tampa’s is now closed.

The main office in Winter Haven is under Total Home Roofing. A

receptionist said they are all merging into Angi’s Roofing.

We then spoke with the marketing director for all three companies, she

said they will look into the text messages Schwebach received.

As for Citrus Contracting, they have 39 complaints with the Better

Business Bureau, many mentioning solicitation, claiming storm damage and

insurance paying for their new roof.

“What is spooky is the minutia of information about that customer so

they're clearly, they're going and targeting the older roofs that they

know are nearing the end of useful life and then baiting the customer,”

Bob Richie told ABC Action News.

Ritchie is the CEO of American Integrity Insurance, one of the largest

domestic property insurance companies in the state.

“One insurance company in particular that we write a lot of business

with, in speaking with, the CEO was telling us that last year he

averaged 26 lawsuits a day for roofs,” Mike Puffer, a partner with

Florida Strategic Insurance told reporter Stassy Olmos in April.

He was talking about Ritchie.

“Twenty-six lawsuits a day, what is the scope of that? How many are you

dealing with?” Olmos asked Ritchie in an interview.

He said it was hard to scale because they can’t afford to go to court

for many.

“We have 250 employees, our largest department by staffing and payroll

is our legal department,” Ritchie explained.

He said it’s been a seven-year battle to sort through the roof storm

damage claims coming in by the dozens, daily.

“Of course, there are valid claims we do, our discovery, our

adjudication, and some, in fact, are covered,” he explained. Most, he

added, are normal wear and tear and should not require an entirely new

roof.

But if they go to court, under Florida Statutes, they’re at high risk of

paying a fee multiplier two to three times the attorney’s hourly rate.

“We see some law firms filing these frivolous lawsuits literally by the

thousands,” said Mark Friedlander a spokesperson with the Insurance

Information Institute told ABC Action News. “More than 100,000 lawsuits

were filed against property insurers in 2021, roughly 79% of all

lawsuits in the U.S.”

A study called 'Florida’s P&C Insurance Market: Spiraling Toward

Collapse' commissioned by the Senate Banking and Insurance Committee

found that of the $15 billion that went to litigated claims since 2015:

“I can tell you that many of the lawsuits that come

in, we are having to settle which obviously increased our cost and

increase the need for additional rate increases,” Ritchie said.

Many of his clients' premiums have doubled, and some have tripled.

“We're projecting 30% to 40% average increases this year across the

board. With so many homeowners seeing renewals 50% or much more than

that,” Friedlander added.

Ritchie said the solution is simple: actual cash value on roof repairs

covered by insurance and guidelines to limit fee multipliers.

A property insurance bill with changes to roof replacement costs passed

the senate in this last legislative session but died in the house.

“The House wouldn't take it up, and that's the concern we have for this

special session,” Friedlander said. “We're still not seeing House

leadership commit to making major changes to property reform that would

help the situation.”

The special session starts May 23 and while we haven’t seen any details

or drafts of possible changes, we know they are looking at:

-

actual cash value replacement on roofs (ACV)

-

help for Citizens Property Insurance

-

changes to the hurricane catastrophe fund to

reduce how much insurance companies pay into the fund to help with

homeowner’s rates

Keep in mind the Insurance Information Institute said

it takes about a year and a half for legislation to really show any

changes.

As for Schwebach, he said regardless of finances, he’s going to do

things the right way.

“I just bought a new house last month and it’s got an 11-year-old roof,

and I will be replacing it out of my pocket,” he said.

We are waiting to hear back from Citrus Contracting under Angi’s Roofing

regarding those specific texts.

When we asked Ritchie what he would say to American Integrity customers,

he said:

“I will first tell you that we're doing everything in our power to solve

this crisis for you. I'm honored to be your insurer. I'm very sorry for

the rate increases. I know the financial pain is putting you under and

there's no easy way out until the right legislative reform is enacted. I

will tell you that I believe that we will get this solved, yet I know

the heartaches that you're experiencing. I read every email, every

letter coming in. I know you've had to take tough actions, such as

dropping your insurance.. such as reducing your coverage, so you don't

have everything that might be covered under the policy, such as making

life choices of food on the table or insuring your home, because these

rate increases are not nominal. We're talking about major changes to

household budgets and it's immoral. It didn't have to be this bad, but I

can promise you this, as your CEO, I've been about the most active in

Tallahassee and I’m not there to win a popularity contest and it doesn't

feel like it because our premiums are still going up, not down, but I’m

going to fight for all of us."

|