Florida homeowner without insurance while trying

to close previous mold claim

Palm Harbor homeowner whose

insurance went into receivership this year is waiting for her

homeowner's association to help with mold claim |

|

Article Courtesy of ABC ACTION NEWS

By STACY Olmos

Published

September 23, 2022

|

WATCH VIDEO |

WHAT IS THE PRICE OF PARADISE?

As Tampa Bay continues to attract new residents and

businesses, the impact of living in paradise comes at a cost for all of

us— from the increasing cost of housing and infrastructure to utilities

and insurance. ABC Action News is committed to helping you and your

family make the most of your money and navigate through the Price of

Paradise.

|

It’s hurricane season in Florida, and the

reality is that some homeowners who had existing claims with

insurance companies that have gone into receivership are

still without coverage while previous claims are still open.

In March, we met Palm Harbor homeowner Judy Slater who

discovered mold in several places in the condo at El Pasado

that she had recently moved into. She had opened a claim

with her property insurance, Avatar, which went into

liquidation shortly after. Her claim became one of the

thousands that the Florida Insurance Guaranty Association (FIGA)

had to pick up from companies that’d gone under.

Mold remediation

Now it’s September, the height of hurricane season, and

Slater’s home isn’t covered by any property insurance.

|

|

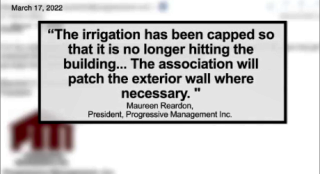

Waiting for her homeowner's association to help with

mold claim.

|

“Til the claim is closed, there's no insurance. And

then, once we get the finalization that the claim is closed and I get

the documentation to show the claim is closed, then I can get

insurance,” Slater explained. “From talking to one of the insurance

companies, I was initially told that as long as I have a contract that

they can proceed to an insurance. I've been ghosted.”

Ghosted means they’ve stopped talking to her, which would make sense for

a company that doesn’t want to take on a home with pre-existing issues.

On September 1, Slater pulled money from her 401k to get the mold

remediation done.

We went to meet the remediation company to see how big the job was, and

it turns out it was a lot more mold than they anticipated.

“There’s different containments… we have one for that exterior wall and

we have another one for the bathroom,” Florida’s Elite Restoration

Co-Owner Josh Martin said.

He used to be an insurance adjuster and started this business to help

people with water damage, not knowing most of his work would be just

like Slater’s condo.

“Probably… 80 to 90% of every job we do ends up being a mold job

because, by the time we get to it, you pull back the baseboards, you

look at the cabinetry, there's mold everywhere,” Martin said.

He added that he’s seen many homeowners and associations that don’t

understand their responsibility.

“People just kind of presume I think that every insurance policy is the

same, and it's not,” Martin exclaimed. “There's 10K water caps now that

are popping up everywhere… Or even your deductibles. Like for example,

State Farm has a percentage deductible… you file a claim and you have a

$14,000 deductible when your kitchen could cost $14,000.”

In Slater’s case, we looked up the Florida Condominium Act which states

a homeowner’s association is responsible to maintain “common elements”

such as the roof and exterior walls shared with other units.

We then spoke with a Florida attorney who represents homeowners in cases

like Slater’s, who said an outside sprinkler causing water to eat at

paint and get into drywall would be water intrusion from a common

element, which could legally be the HOA’s responsibility.

Unfortunately, Slater’s condo did not pass its first air test after

remediation, so the company will keep working until they find all of the

mold.

“I'm glad you're in my corner, but if somebody's going through this,

they have to be their own advocate… they can't give up,” Slater said.

Three important lessons for any homeowner to keep in mind:

-

When buying a home, inspectors look for water

damage, not necessarily mold

-

Know your property insurance company and the

details in your coverage

-

If you have an HOA, read the declaration and know

what their responsibilities are

|