|

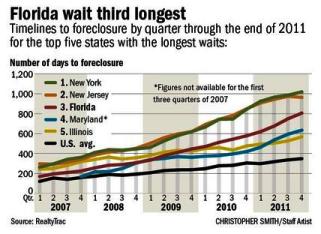

Article Courtesy of The Palm Beach Post By Kimberly Miller Published January 14, 2012 A foreclosure filed today in Florida will linger in the courts until March 28, 2014, before the bank takes possession, a timeline that has increased 40 percent in the past year. RealtyTrac analysts, who released new foreclosure data today in a 2011 year-end report, blame the increase in time from initial filing to bank takeover on the robo-signing scandal that pushed lenders to review and redo paperwork in thousands of cases.

That's reflected, Moore said, in plummeting foreclosure activity last year. Florida saw a 63 percent decrease in properties receiving a foreclosure filing compared with 2010. Palm Beach County was down 58 percent. Nationally, there was a 34 percent dip. Still, since April 2005, lenders have taken back 367,712 Florida homes through foreclosure, according to RealtyTrac, which measures only residential foreclosures. In Palm Beach County, bank repossessions during the same period total 23,498. Another 34,819 foreclosure cases are pending in Palm Beach County courts, according to the clerk of courts office. Statewide, there's an estimated backlog of more than 260,815 cases. But Ken H. Johnson, a Florida International University real estate professor, said borrowers in foreclosure have a better chance of keeping their homes today than they did in the early years of the housing crisis. The court logjam and difficulty in finding paperwork will push lenders to work out alternative deals with borrowers, such as loan modifications, short sales or deeds in lieu of foreclosure, he said. "Banks like workouts now better than foreclosures," Johnson said. "They understand that doing something other than a foreclosure is probably a very reasonable thing." Jack McCabe, chief executive of McCabe Research & Consulting in Deerfield Beach, said he's spoken to homeowners who have had tens of thousands of dollars trimmed off their home loan debt by lenders - an unthinkable strategy until recently. "They seem to be doing principal reductions privately, secretly and discreetly, and don't want to publicize it as a national policy," he said. Lender willingness to look at other options is also part of why RealtyTrac predicts there will be no more massive foreclosure waves, although filings will pick up through 2012 as banks recover from paperwork flaws. Daren Blomquist, a spokesman for RealtyTrac, said the company was surprised by the persistence in foreclosure processing delays that lasted most of 2011. The company had predicted that filings would perk up in early January 2011, just after the robo-signing issues surfaced. Increases didn't begin, however, until late in the year. "It is somewhat surprising how lasting of an impact the questionable foreclosure procedures have had on the foreclosure industry in Florida," Blomquist said |