|

Article

and Video Courtesy of The Orlando Sentinel

By Mary

Shanklin

Published

November 18, 2013

|

Watch

VIDEO Watch

VIDEO

|

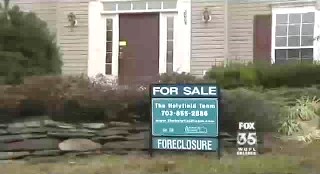

Even though Central Florida's housing market has been recovering for more than a year, the number of Orlando-area homeowners entering foreclosure has increased for a second consecutive month, a new report shows.

First-time foreclosure filings in Metro Orlando rose 38 percent from September to October, according to a report released today by the real-estate research firm

RealtyTrac.

|

Florida as a whole saw an increase of 36 percent in first-time filings. Nationally, however, those initial notices increased by only 4 percent.

The statewide increase may be tied to a new foreclosure-expediting law that took effect in July, experts said.

"It's typically a pattern when a law changes that affects the foreclosure process," said Daren

Blomquist, vice president of RealtyTrac. After Florida's law took effect, |

|

|

banks could process uncontested foreclosures without going through the usual process, which took about four years.

It appears that lenders took a few months to catch up to the new procedures, Blomquist said. Initial foreclosure filings fell by almost half in the months after the new law took effect. Now the first-time actions are climbing again, he added.

"You tend to see a dropoff in filings right away because lenders have to change their procedures, and that is followed by an increase in filings as lenders adjust to the new law."

Whatever the reason, banks launched hundreds of additional foreclosures in the Orlando area in October compared with the previous two months.

|

Within the four-county region, 2,745 new foreclosure actions were filed for initial notices, auction notices and sales during October. Of those, 1,232 were for houses just entering the foreclosure pipeline — 82 percent more than in August.

Throughout Metro Orlando, first-time foreclosure notices rose sharply in Orange and Seminole counties but declined somewhat in Lake and Osceola. Most notably, the number of actions in Orange jumped from 630 in September to 896 in October. |

|

|

Of the four counties that make up the metropolitan area, only Orange showed an increase between the second and third quarters in the number of houses that started foreclosure.

Even though first-time foreclosure notices in the Orlando area have increased during recent months, they remain down about 28 percent from a year ago.

As the pool of distressed properties shrank during the past year, sales prices for existing single-family homes rose by 24 percent in the core Orlando market, according to the Orlando Regional Realtor Association. The median sales price increased by more than $20,000 during that time to reach $155,475.

Mark Soskin, an economics professor at the University of Central Florida, said it's difficult to pinpoint a reason for the two-month increase in houses entering foreclosure. One possible explanation is that some homeowners have exhausted their savings and have no home equity left to tap for expenses such as medical bills and car repairs. They may feel forced to delay making mortgage payments, he said.

"More people are living paycheck to paycheck," he said Wednesday. "They used to have home-equity loans to fall back on. … A lot of the things they used to be able to use to get out of a problem in the short or medium term are now the kinds of things that throw them over the edge."

The longer-term view shows signs of an overall recovery for the housing market throughout the region. Compared with a year ago, foreclosure actions of all types declined 21 percent in the four-county Orlando area.

|