|

Article Courtesy of The Orlando

Sentinel

By Mary Shanklin

Published

September 2, 2016

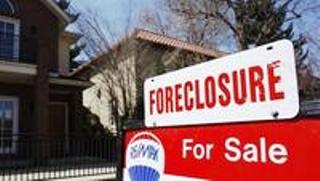

Four years after a national housing group complained

that Bank of America neglected foreclosed houses in Orlando minority

areas, the group on Wednesday said conditions have worsened.

|

The National Fair

Housing Alliance and nine local fair housing

organizations on Wednesday released details of new

complaints about the bank's care-taking practices,

particularly in neighborhoods with mostly

African-American and Latino residents. The coalition

showed what it described as new signs of neglect at

foreclosures in Orlando and other cities.

South of downtown Orlando last month, an

abandoned-looking house owned by Bank of America was

unsecured and showed signs of squatters living inside,

black plastic bags of trash and tree-limb debris piled

up in open carport bays. Photos released four years

earlier show the same house was vacated but not used as

a dumping ground and camp for vagrants. |

|

|

"The property was poorly maintained on each visit, but it is actually in

even worse shape in 2016 — seven years after the National Fair Housing

Alliance put Bank of America on notice about its problems maintaining

foreclosures," according to a report released Wednesday by the alliance.

Bank of America officials have said the bank shares concerns about

neglected, foreclosed properties but stands behind it property

maintenance practices.

David Baade, president of the Melbourne-based nonprofit Fair Housing

Continuum Inc., said conditions of foreclosures in Orlando and elsewhere

have eroded as complaints have languished with the federal government

and the Bank of America.

"We don't think any of the lending institutions are taking it seriously,

other than Wells Fargo," Baade said Wednesday.

The fair-housing coalition added Orlando to its eight-city complaint in

2012 and added six new cities this week to the complaint filed with the

U.S. Department of Housing and Urban Development.

In 2013, the group's concerns led Wells Fargo to announce it would

invest $39 million to support home ownership, neighborhood

stabilization, property rehabilitation and housing development in 45

communities throughout the U.S., according to HUD. The settlement came

through the federal agency.

On Tuesday, HUD spokesman Brian Sullivan said the agency takes the

complaints seriously and continues to review the condition of bank-owned

homes in various types of neighborhoods to determine whether Bank of

America or other institutions are discriminating in their maintenance of

properties.

HUD had closed an investigation into U.S. Bank maintenance practice but

is taking another look based on the group's continued concerns, he

added.

|