|

Article Courtesy of The Tampa

Bay Times

By D'Ann Lawrence White

Published

February 13, 2017

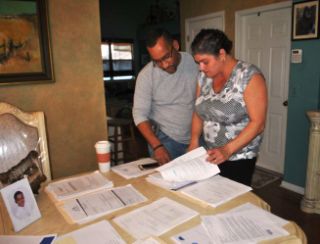

RIVERVIEW Tina and Luis Lopez have owned their

Rivercrest home for 12 years, raised two children there, even taken part

in community events including the holiday decorating contest.

|

Now, they're just

one step away from eviction not for failing to keep up

the payments like so many homeowners during the Great

Recession but for missing one annual homeowners

association fee that amounted to no more than $150.

Worse yet, they even have a canceled

check showing they made the payment.

Still, late fees, lawyers costs and liens that have

accrued in the seven years since then combined with a

notification system that favors the homeowners

association over the homeowners landed their property

on the auction block.

Only a judge can keep them in their home now. A hearing

on their appeal of the sale was held Jan. 25 and they

await a ruling.

"We were good neighbors. We followed the rules," said

Tina Lopez, 43. "How can people be so cold-hearted?" |

|

|

The Lopez family is just one of the 1,386 owners of single-family homes,

town homes and villas who are expected to pay dues each January to the

Rivercrest Community Association. But they're not the only ones raising

questions about the association's aggressive pursuit of fees.

This approach can end in foreclosures that attract investors who open

the community to rentals a concern of former association board member

Cheryl Cusack. In the past two years, Cusack said, the number of rentals

has grown to account for 39 percent of all homes in Rivercrest.

"These are the people who are supposed to be looking out for residents.

They're supposed to make Rivercrest a better, safer community," she

said. "Personal agendas, egos and the need for power have gotten in the

way and morphed the homeowners association into a money-making machine

at the expense of the community and its residents."

In 2015, the Tampa law firm that goes after fees for the homeowners

association settled a class action suit in which it was accused of

misleading property owners about consumer rights, inflating debts, and

failing to give them a chance to agree on fee amounts.

Michael Greenwald, the Boca Raton attorney who brought the lawsuit, said

the Tampa firm, Bush Ross, makes its money by collecting from individual

homeowners rather than taking a flat fee from the many associations it

represents.

This puts homeowners at a big disadvantage, Greenwald said.

"In its effort to collect delinquent homeowners' fees," he said, "Bush

Ross takes legal action that can result in property owners losing their

homes."

Upon settlement of the class action suit, 258 property owners

including the Lopez family in Rivercrest received checks of $300 from

Bush Ross.

But the settlement proved disastrous for the Lopezes. They thought it

meant they were finally even with the homeowners association. As turns

out, their debt just spiraled faster.

The family's troubles, they say, began in 2009 when the homeowners

association failed to record the Lopez's annual $150 dues payment.

The association doesn't send out bill notices, expecting property owners

on their own to send in the money each January. The Lopezes paid it

late, May instead of January, but Lopez has a copy as she does for each

of the 12 years they've lived in Rivercrest.

"They never notified us of any problem so we had no reason to think they

hadn't received our check," she said.

Brian Smith, who lives down the street from the Lopezes, also faulted

the association for its lack of notice and for what he called

"strong-arm tactics."

"Residents are living in a state of fear," Smith said. "The HOA expects

us to pay our annual fees each January but they don't send out a due

letter. With everything happening around the holidays, it's easy to

forget to pay."

Four years later, in October 2013, the Lopez family received a notice

from Bush Ross that the firm would be placing a lien on their property

unless they paid the disputed dues plus late fees, administrative fees

and interest a total of $785 within 30 days.

"We were stunned," Tina Lopez said. "We had all the records showing we

had sent in all of our dues. This didn't make sense."

It made sense to Cusack, the former association board member. In 2009,

she said, the association was in the process of changing management

companies over concerns about proper record keeping.

"Checks were lost; people weren't credited when they paid their dues,"

Cusack said.

Two board members spent days going through the books, trying to find all

the errors.

"Unfortunately, they didn't catch the mistake with Tina's check."

The Lopezes said they couldn't afford to pay $785. They were facing

expenses related to job layoffs, hospitalizations, and starting their

own cleaning company. Instead, they offered the proof that they had paid

year after year.

They didn't realize that all those payments after 2009 didn't go to

their annual dues but toward administrative and late fees imposed by

Bush Ross in connection with the disputed payment.

Bush Ross responded by filing a lawsuit on behalf of the homeowners

association board. By that time, the firm claimed the Lopezes owed

$2,196.

The couple offered to settle for the $785. In an April 2014 letter, Bush

Ross said the board denied the offer but would be willing to set up a

payment plan.

The Lopezes agreed and were making payments when they received the class

action notice from attorney Greenwald, accusing Bush Ross of violating

the Fair Debt Collection Practices Act.

Bush Ross attorney Charles Glausier declined to comment last month on

the Lopez case because the auction sale is still in court. Glausier said

Bush Ross only takes legal action with an association's blessing: "We

follow the direction of the board of directors."

A large part of the firm's practice is representing homeowners

associations, he said, perhaps hundreds of them.

Bush Ross has filed formal notice of liens with the Hillsborough County

Circuit Clerk against 72 homes in Rivercrest, a review of the clerk's

records shows.

"Only 10 to 15 percent of these cases turn into foreclosures," Glausier

said. "It happened more often during the recession when almost every

association was having a rough time collecting fees. But you see it less

today."

The first thing the Lopezes did when they received their $300 settlement

check was to stop making monthly payments to Bush Ross.

"We assumed since they settled, we didn't owe them anymore," Luis Lopez

said.

That decision may cost them their home, said Tampa attorney Betty

Thomas, who took on the Lopez's case two weeks ago.

"I can see why they felt they shouldn't make payments to a law firm that

settled a lawsuit in which they were a party," Thomas said. "They

thought the lawsuit voided their settlement. But it was a mistake not to

continue with the settlement payments."

Once the payments stopped, Bush Ross filed a suit to foreclose.

"We tried to get in touch with them about the lawsuit but we were never

able to talk to anyone," said Luis Lopez, 53. "They say they got in

touch with us to settle but we never received anything by certified or

regular mail."

Glausier said his firm routinely provides property owners notice of any

action it takes, and Thomas acknowledged that there is evidence a copy

of the sale notice was sent to the Lopez's address.

"The odds are against them," Thomas said. "It's a lot tougher to win

these cases when a third party has already put up the funds to purchase

the property."

She added, "They usually put tenants in these homes and rent them out."

Current members of the homeowners association board did not respond to

requests for interviews. The management company for Rivercrest, Wise

Property Management, declined to comment.

Smith, the Lopez's neighbor, said he has had his own battles with the

homeowners' association during the 12 years he's lived in Rivercrest

most recently over weeds in his front garden.

"So we redid the entire garden over Mother's Day and sent the HOA

photos," Smith said. Still, Bush Ross notified him he'd racked up $1,000

in fines and attorney's fees.

"We ended up settling just to get them off our backs," he said.

Smith has sold his home in Rivercrest, saying, "I'll never again live in

a community with a homeowners association."

The Lopezes, meantime, are pleading with a judge to let them stay in

Rivercrest with their children Anthony, 16, and Jessica, 8.

When they bought the four-bedroom, three-bath, two-story home for

$270,000, the couple was moving to Riverview from a cramped apartment in

Brooklyn.

"We thought we were living the American dream," Luis Lopez said, "but

it's turned into a nightmare."

|