|

Article Courtesy of The Miami

Herald

By Jay

Weaver

Published December 15, 2016

When Lloyd Boggio sold his Miami

affordable-housing business a decade ago, he envisioned making hefty

profits from his ongoing investment deals with the new owner of his

company, Carlisle Development Group.

But while his plan seemed to promise a comfortable retirement, Boggio

would soon become entangled in a $34 million housing scheme with the

young Carlisle CEO, Matthew Greer.

“I’m sorry for what happened, and that I

wasn’t able to stop it at an earlier point,” Boggio, 70, said on Friday

in Miami federal court.

|

Boggio, who struck a

plea deal before his trial in September, was sentenced

to about five years in prison. U.S. District Judge

Ursula Ungaro admitted the difficulty of punishing him

in a complex fraud case in which six other defendants

pleaded guilty early on and cooperated with authorities,

resulting in more lenient prison terms.

“I am concerned about equity,” said Ungaro, who also

noted the defendant’s age and declining health.

Boggio was accused last year with Greer and five others

of conspiring to steal U.S. government funds to

subsidize more than a dozen affordable housing

developments in Miami-Dade County through a tax-credit

program designed to create rental apartments for

low-income residents. Greer, Boggio and the others

inflated construction expenses to qualify for higher tax

credits and then shared millions in illicit proceeds by

completing apartment projects at lower costs.

All of the defendants, except Boggio, reached quick plea

agreements on conspiracy charges of stealing government

funds. Boggio, the oldest of the defendants, eventually

pleaded guilty to money laundering. He also agreed to

turn over $2 million from bank accounts, along with

proceeds from the pending sale of a multimillion- dollar

luxury home in Coconut Grove in an effort to satisfy a

$7.2 million forfeiture judgment.

But Boggio, who must surrender in February to start his

prison term, could have obtained a lesser sentence had

he cut a deal at the outset rather than prepared to

fight the U.S. attorney’s office at trial over the past

year.

In contrast,

the judge recently sentenced Greer, 38, to just three

years in prison, though he stole twice as much — $16

million — as Boggio did from the federal tax- credit

program, his defense attorneys, Scott Srebnick and

Edward Shohat, pointed out at Friday’s hearing. As part

of his plea deal, Greer repaid all that money to the

government. |

|

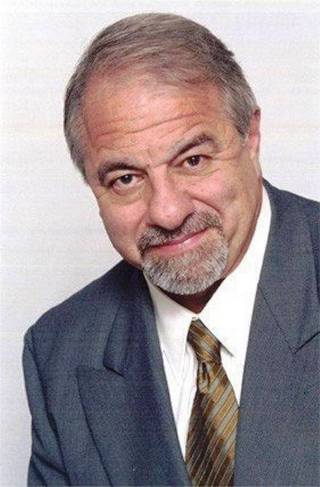

Lloyd Boggio, 70, was sentenced to about 5 years

in prison after agreeing to a plea deal on a charge of money

laundering.

|

Greer, Carlisle’s successor, had pleaded

guilty to two theft conspiracy counts in a plea deal that required him

to testify against his former mentor, Boggio. Boggio’s defense team

initially planned to attack Greer as a witness by questioning him about

the role of his parents, attorneys Bruce and Evelyn Greer, in Carlisle’s

projects.

Bruce Greer had started the company with Boggio two decades ago, and

Evelyn Greer, a former mayor of Pinecrest and ex-member of the

Miami-Dade School Board, advised her son and Boggio on Carlisle’s deals,

according to court records.

The Greer parents, who were never under investigation, received immunity

from prosecution in a once-secret side agreement to the son’s plea deal

last year. Boggio’s planned defense strategy that he committed no

wrongdoing and was simply relying on the advice of Greer’s mother never

unfolded at trial because of his own plea deal.

Thanks to his parents’ financial backing, Greer bought out Boggio’s

interest in Carlisle in 2007. The following year, Greer replaced him as

CEO, but Boggio retained profit interests in several of Carlisle’s

projects that were still in the pipeline.

Prosecutor Michael Sherwin said that while Boggio taught Greer how to

carry out the tax-credit scheme, Greer put it on “steroids.” Greer also

transformed Carlisle into the biggest developer of affordable housing in

Florida.

Last year, Greer and Boggio were accused of conspiring with former

development partners, Biscayne Housing Group’s co-founders Michael Cox

and Gonzalo DeRamon, as well as with South Florida contractors Michael

Runyan, Rene Sierra and Arturo Hevia. Collectively, the developers stole

about $34 million in federal housing subsidies by inflating construction

costs and receiving kickbacks, according to FBI and IRS agents. The

contractors, who paid the kickbacks, kept a portion of that money, too.

Last week, the judge sentenced DeRamon to 1 1/2 years in prison, but

gave lenient probationary sentences to the other four defendants, along

with some home confinement and community service. She also ordered them

to repay their share of money stolen from the federal tax-credit

program.

|